Tulsa, Ok Bankruptcy Attorney: A Lifeline In Challenging Times

Tulsa, Ok Bankruptcy Attorney: A Lifeline In Challenging Times

Blog Article

Tulsa Bankruptcy Attorney: How To Manage Bankruptcy And Mortgage Debt

Table of ContentsThe Role Of A Tulsa Bankruptcy Attorney In Small Business BankruptcyTulsa Bankruptcy Lawyer: Overcoming The Stigma Of Bankruptcy In The WorkplaceBankruptcy 101: A Guide By Tulsa Bankruptcy AttorneysBankruptcy Attorney Tulsa: How They Help You Get Back On Track

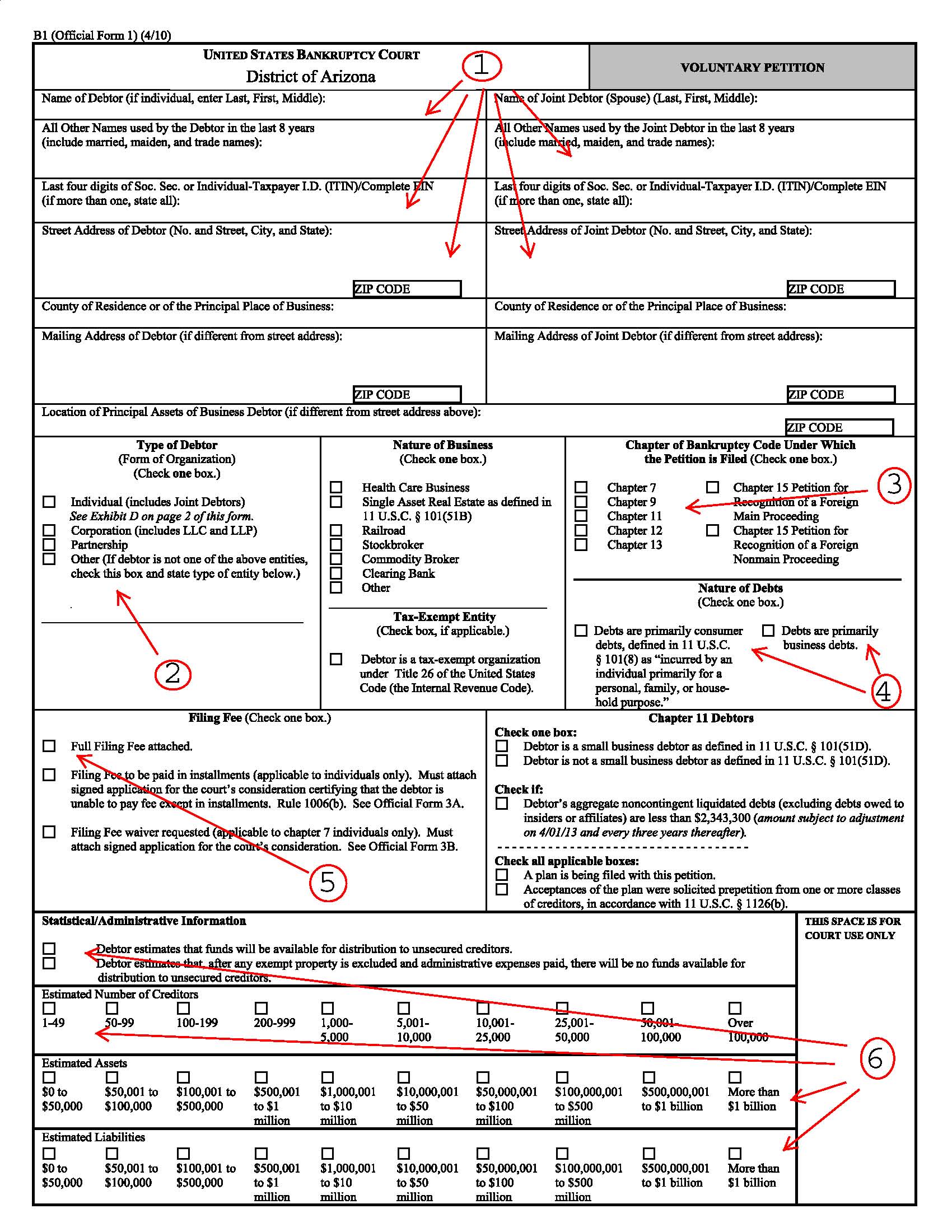

It can harm your credit history for anywhere from 7-10 years and be a barrier towards getting safety clearances. Nonetheless, if you can not resolve your troubles in less than five years, personal bankruptcy is a practical alternative. Legal representative fees for insolvency vary depending on which develop you select, just how complicated your case is and also where you are geographically. Tulsa bankruptcy lawyer.Various other bankruptcy prices consist of a declaring charge ($338 for Phase 7; $313 for Phase 13); and fees for debt therapy and also monetary monitoring programs, which both price from $10 to $100.

You don't constantly require an attorney when submitting private personal bankruptcy by yourself or "pro se," the term for representing on your own. If the case is basic enough, you can apply for bankruptcy without help. Most individuals benefit from representation. This article discusses: when Chapter 7 is also made complex to manage yourself why hiring a Phase 13 legal representative is constantly vital, as well as if you represent yourself, just how a personal bankruptcy application preparer can aid.

The basic regulation is the simpler your personal bankruptcy, the much better your chances are of finishing it by yourself and obtaining an insolvency discharge, the order removing financial obligation. Your case is most likely easy adequate to manage without an attorney if: Nevertheless, also straightforward Phase 7 situations need job. Strategy on filling in extensive documents, collecting financial documentation, looking into insolvency and exception legislations, as well as complying with neighborhood policies and procedures.

Tulsa Bankruptcy Lawyer: The Most Common Types Of Cases

Right here are two scenarios that constantly call for representation., you'll likely want a legal representative.

If you make a blunder, the insolvency court might toss out your situation or offer assets you assumed you could maintain. If you lose, you'll be stuck paying the financial obligation after bankruptcy.

If you make a blunder, the insolvency court might toss out your situation or offer assets you assumed you could maintain. If you lose, you'll be stuck paying the financial obligation after bankruptcy. You could desire to submit Chapter 13 to catch up on home loan arrears so you can keep your home. Or you could intend to do away with your second home mortgage, "pack down" or reduce a vehicle loan, or repay a debt that won't go away in bankruptcy gradually, such as back tax obligations or assistance arrears.

You could desire to submit Chapter 13 to catch up on home loan arrears so you can keep your home. Or you could intend to do away with your second home mortgage, "pack down" or reduce a vehicle loan, or repay a debt that won't go away in bankruptcy gradually, such as back tax obligations or assistance arrears.Lots of people realize the lawful costs called for to work with a personal bankruptcy lawyer are rather affordable once they understand how they can benefit from an insolvency lawyer's aid. In a lot of cases, a personal bankruptcy legal representative can rapidly recognize issues you could not spot. Some individuals declare personal bankruptcy since they don't comprehend their alternatives.

The Role Of Tulsa Bankruptcy Attorneys In Personal Bankruptcy

For most customers, the rational choices are Phase 7 and also Chapter 13 insolvency. bankruptcy attorney Tulsa. Phase 7 can be the method to go if you have low income and also no assets.

Staying clear of documentation risks can be problematic also if you pick the right phase. Below are typical concerns bankruptcy legal representatives can stop. Bankruptcy is form-driven. You'll have to complete a lengthy federal package, as well as, in many cases, your court will likewise have neighborhood kinds. Lots of self-represented bankruptcy debtors do not file all of the needed bankruptcy papers, and also their situation gets disregarded.

You do not shed every little thing in bankruptcy, but maintaining property depends on recognizing just how building exceptions job. If you stand to lose useful home like your home, vehicle, or other building you appreciate, a lawyer could be well worth the cash. In Chapters 7 as well as 13, personal bankruptcy filers need to get credit history therapy from an approved service provider before submitting for insolvency as well as complete a financial monitoring training course prior to the court provides a discharge.

Not all bankruptcy cases proceed efficiently, as well as various other, extra difficult problems can develop. Lots of self-represented filers: don't recognize the significance of activities and also adversary actions can't properly defend versus an activity looking for to reject discharge, and have a tough time conforming with complex personal bankruptcy procedures.

Bankruptcy Attorney Tulsa: How Bankruptcy Laws Have Evolved Over Time

Or something else could chop up. The bottom line is that a lawyer is essential when you find on your own on the obtaining end of an activity or legal action. If you make a decision to file for insolvency on your own, figure out what services are available in your area for pro se filers.

Others can connect you with legal help organizations that do the very same. Lots of courts as well as their sites know for consumers declaring personal bankruptcy, from sales brochures defining affordable or totally free solutions to in-depth information concerning insolvency. Obtaining a good self-help book is also a superb concept. Look for a bankruptcy publication that highlights scenarios calling for an attorney.

You should go right here properly fill in many types, study the regulation, and also attend hearings. If you comprehend bankruptcy regulation yet would you can try here like assistance finishing the kinds (the average insolvency application is approximately 50 web pages long), you might think about working with a bankruptcy application preparer. A personal bankruptcy petition preparer is any kind of person or company, besides an attorney or a person that functions for an attorney, that bills a cost to prepare bankruptcy records.

Due to the fact that personal bankruptcy petition preparers are not lawyers, they can not offer legal advice or represent you in personal bankruptcy court. Especially, they can not: tell you which kind of personal bankruptcy to submit tell you not to detail specific financial debts tell you not to list certain assets, or tell you what property to excluded.

Due to the fact that personal bankruptcy petition preparers are not lawyers, they can not offer legal advice or represent you in personal bankruptcy court. Especially, they can not: tell you which kind of personal bankruptcy to submit tell you not to detail specific financial debts tell you not to list certain assets, or tell you what property to excluded.Report this page